company income tax rate 2019 malaysia

Here are the income tax rates for personal income tax in Malaysia for YA 2019. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying.

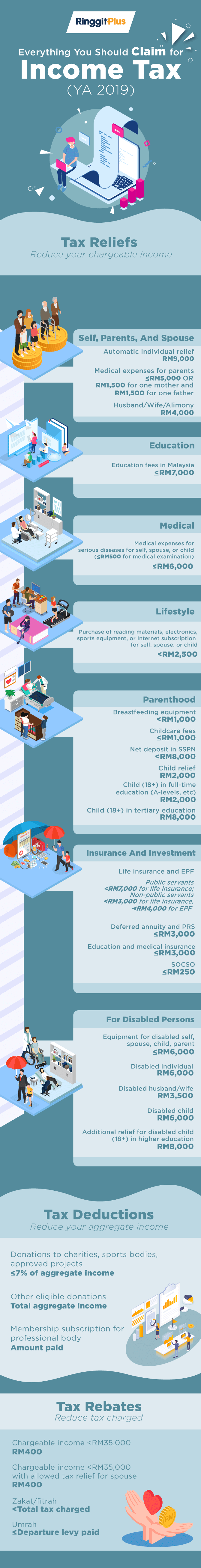

Malaysia Personal Income Tax Guide 2020 Ya 2019

Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following.

. Based on this amount the income tax to pay the. To encourage more investors and businesses to set up in Malaysia the government has initiated a few tax incentives. Resident individuals chargeable income rm ya 20182019 tax rm on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800.

As of 1 January 2019 individuals who derive in a tax year income exceeding PLN 1 million are required to pay. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. The new TAFs reiterate that in the event any understatement or omission of income is discovered during an audit a penalty which is equivalent to the undercharged tax amount ie 100 may.

Malaysia Personal Income Tax Rate. The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia. On the First 5000 Next 15000.

At minimum the road tax for an engine-driven car is RM20 for. Tax Rates for Company Company tax applies to all those companies that are registered in Malaysia. Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person other than a.

Tax Rates for Individual Assessment Year 2019. It is applicable on chargeable income that a company derives from its business. Calculations RM Rate TaxRM A.

Resident SMEs SMEs are companies with paid up share capital of less. A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. For example lets say your annual taxable income is RM48000.

13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income. Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person. For the purpose of the Malaysia corporate tax rate a small or medium company is one that is incorporated in the country and has a paid-up capital of 25 million MYR or less and.

On the First 5000. For year of assessment 2022 only a special one-off tax will be imposed on companies excluding companies that enjoy the 17 reduced tax rate above that have. Tax Rate of Company.

For instance companies for year of assessment YA 2019 whose. Resident companies are taxed at the rate of 24 while those with paid-up capital. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum.

This rate is relatively lower than what. Assessment Year 2019 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income. The business tax Malaysia or company tax for both resident and non-resident companies in Malaysia is 24.

20182019 malaysian tax booklet 22 rates of tax 1. A corporate tax rate of 17 to 24 is imposed upon resident and non-resident companies on taxable income that is sourced from or obtained in Malaysia. On the First 20000.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia. These companies are taxed at a rate of 24 Annually.

Ranking Of The 50 Most Profitable Companies Worldwide 2020 Statista

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Federal Income Tax Rates For 2019 2020 H R Block

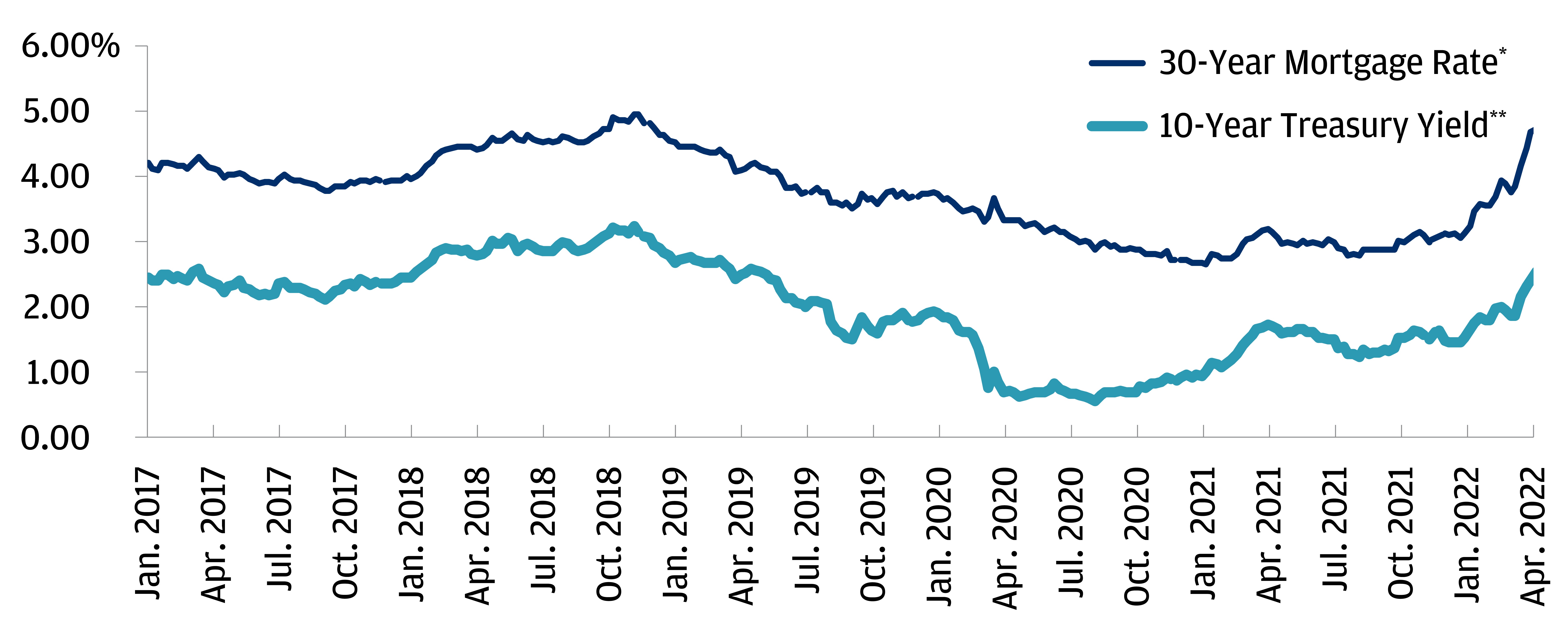

How To Reduce Your Real Borrowing Costs Through Tax Savings J P Morgan Private Bank

These Companies May Be Subject To The One Off 33 Prosperity Tax The Edge Markets

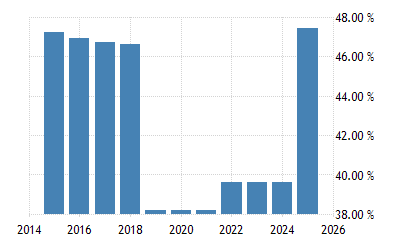

Norway Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Singapore Raises Income Tax Rates For Top 5 Per Cent And Malaysia Anilnetto Com

Corporate Tax Rates Around The World Tax Foundation

Malaysia Corporate Income Tax Rate Tax In Malaysia

Chart Income Tax Around The World Statista

Taxing The Rich The Evolution Of America S Marginal Income Tax Rate Infographic

Malaysia Personal Income Tax Guide 2020 Ya 2019

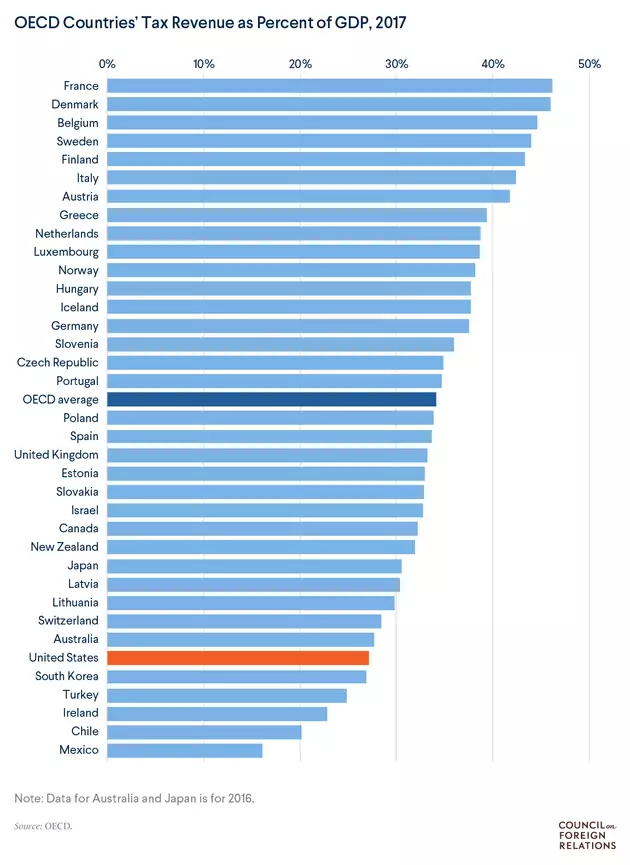

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

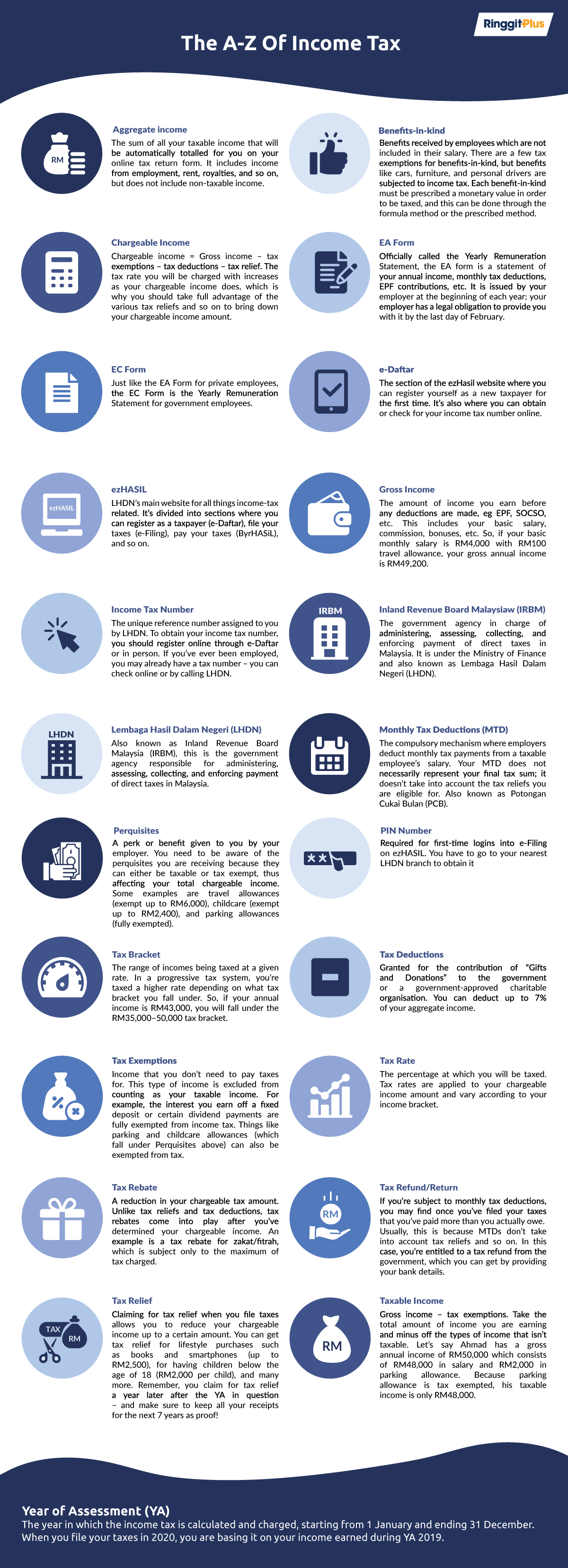

Malaysia Income Tax An A Z Glossary

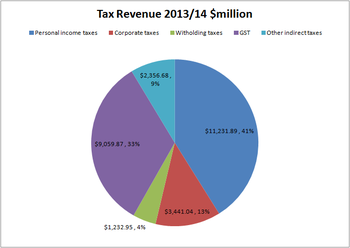

Taxation In New Zealand Wikipedia

Ecuador Tax Preparation Time Data Chart Theglobaleconomy Com

Comments

Post a Comment